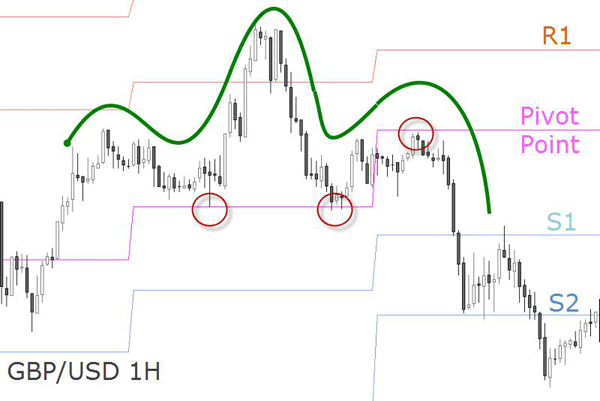

Navin looks at Pivot Points in a very specific and unconventional manner: by focusing on the previous 3 days Pivots, and thereby on the recent three days S and R levels. The memory contained in the price-Pivot interaction explains a lot of the false breakouts, the sudden reversals in between Pivot Levels, and over shootings so common in leveraged markets. The presenter combines this observations with candlestick formations considering not only body shapes but also their wicks and tails. This recorded live session is not a stand alone strategy, but it definitely enhances the traders' ability to identify where buyers and sellers are sitting, and be able to trade in sideways moving markets as well as trending ones.